Regardless of the sturdy restoration in Bitcoin final night time to beat the large promoting, the bulls struggled to carry the momentum to proceed the restoration rally. After making a 24-hour excessive at $102,569, the BTC worth took a fast reversal.

With an intraday pullback of two.74%, Bitcoin at present trades at a market worth of $98,682. With a brand new bearish candle within the day by day chart, Bitcoin is now hinting at a protracted downtrend.

Will this downfall in Bitcoin lead to a breakdown of the native development line to crash beneath the $90,000 mark? Let’s discover out.

Bitcoin Evaluation Reveals Maintain-Off Above 50 EMA

Within the day by day chart, the large lower cost ejection within the current bullish candle appears fairly evident. Nevertheless, the bullish restoration is usually undermined with the intraday bearish piercing candle.

This breaks beneath the 50-day EMA line as Bitcoin loses its assist on the $100,000 psychological mark. Nevertheless, the stochastic RSI strains give a optimistic crossover within the oversold territory, hinting at a possible restoration.

Moreover, the bullish engulfing candle on February 3 highlighted a robust assist for Bitcoin close to $97,700. Therefore, so long as Bitcoin sustains a closing worth above $97,000, the uptrend is prone to proceed.

Indicators of Bullish Sentiment in Bitcoin Derivatives

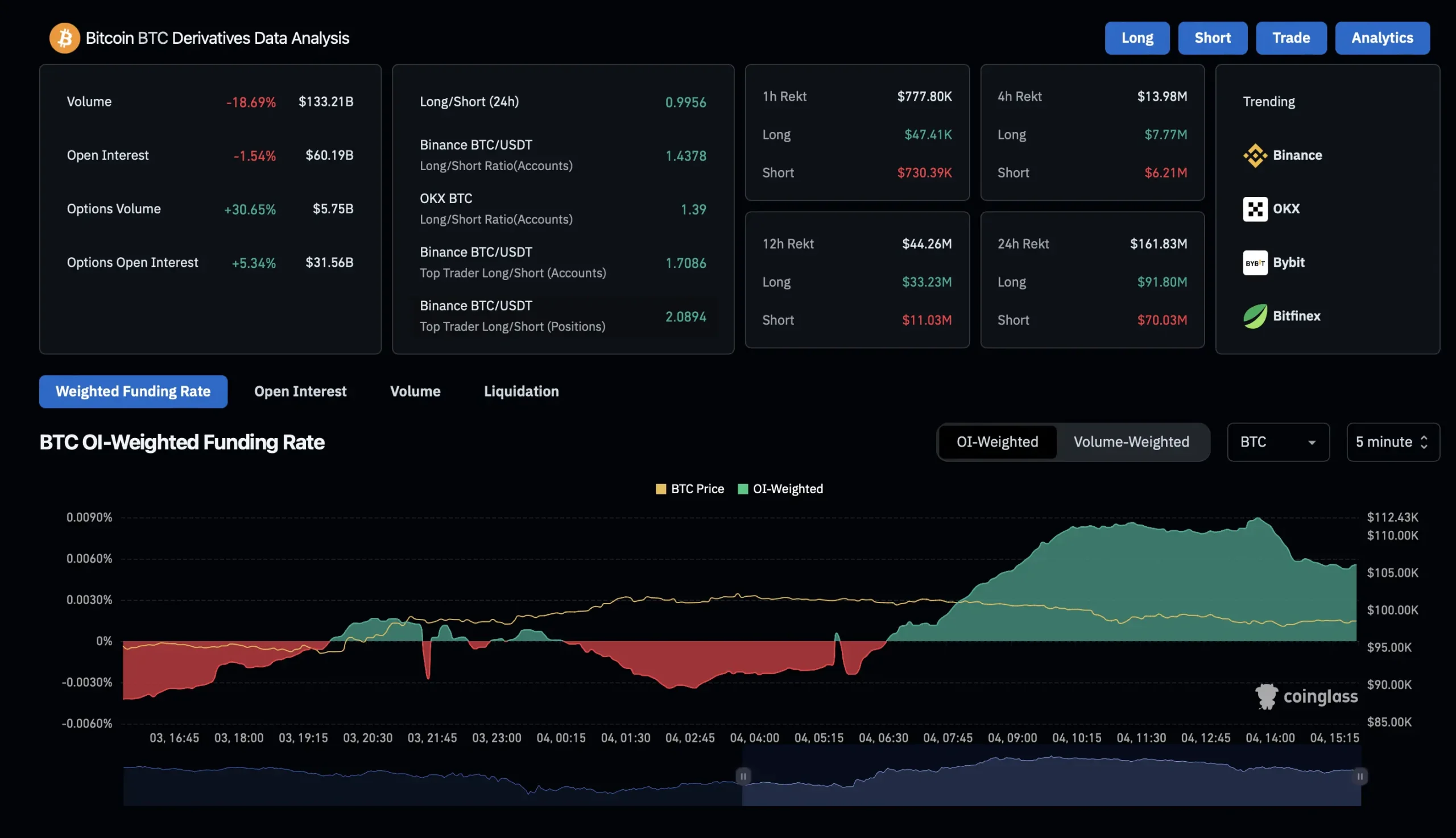

Amid the rising volatility within the BTC worth development, the derivatives market witnessed a minor restoration. The funding rate in Bitcoin has returned to optimistic ranges after momentarily dipping at -0.0032%.

At present, the funding charge stays at 0.0054%, reflecting a surge in bullish sentiments. Moreover, the long-to-short ratio over the previous 24 hours has resurfaced to just about regular ranges at 0.9928.This reveals nearly equal elements of bearish and bullish positions at play. In the meantime, the open curiosity stays at $60.21 billion, marking a slip of -2% over the previous 24 hours.

Therefore, regardless of the pullback within the open curiosity, the general outlook within the derivatives market stays extremely optimistic, because the bulls are keen to pay the premium to carry their lengthy positions.

Bitcoin Institutional Exercise: ETF Outflows Increase Considerations

The stable optimism within the derivatives market comes regardless of the numerous outflow within the US spot Bitcoin ETFs. The establishments on February 3 recorded an general web outflow of $234.54 million.

Among the many prime sellers, Constancy bought $177.64 million, whereas ARK and 21Shares bled $50.75 million. The only real buy of Bitcoin stays with Grayscale, with an influx of $8.02 million.

Nevertheless, its cumulative influx nonetheless stays at a unfavorable $21.88 billion.

Bitcoin Value Targets

Amid rising speculations, the short-term goal in Bitcoin is prone to attain the overhead ceiling at $104,555. Nevertheless, a declining development in Bitcoin ETFs will delay the downfall in BTC costs.

Therefore, on the flip aspect, an important assist beneath $97,500 stays the assist development line close to $94,600.